This article appeared in the Vancouver Sun on February 15th, 2011 and was written by Brian Morton.

B.C.’s real estate market appears to be morphing into two categories: Metro Vancouver and the rest of the province.

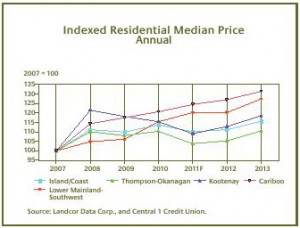

While Metro Vancouver saw a strong increase in the average home price over the past year – up 19.6 per cent in January compared to January 2010, from $638,000 to $763,000 — that’s not the case for most other regions of B.C., according to a survey released Monday by the B.C. Real Estate Association, which represents 11 real estate board across the province and 18,000 realtors.

Except for Metro Vancouver, the Fraser Valley and – for this month, at least – the Kootenays, the province has seen average prices fall, in some cases substantially, in every region in January compared to the same month last year.

“There’s certainly a divergence in the market [between] the south coast and the rest of the province,” BCREA chief economist Cameron Muir said in an interview Monday. “There’s very strong market activity in parts of Vancouver. And that’s skewing the average price higher.”

Despite the difference between Metro Vancouver and the rest of the province, Muir said the numbers can be misleading because the huge increase in Metro Vancouver’s average price was largely because of a surge in purchases of luxury, executive homes in Richmond and the west side of Vancouver.

He said the “benchmark” price — the price of a typical home in Vancouver — actually rose just a bit more than two per cent over the year. He did not have information on benchmark prices for elsewhere in the province.

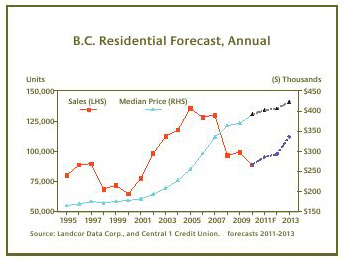

According to the BCREA survey, the average price of a home in B.C. rose 11.5 per cent, to $548,183, in January compared to January, 2010.

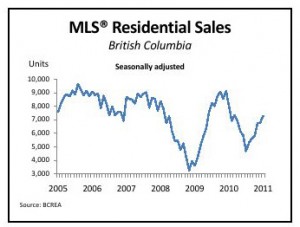

The BCREA also said that Multiple Listing Service sales climbed seven per cent in January from December 2010, on a seasonally adjusted basis.

Compared to January of last year, home sales were down 10 per cent, to 4,137 units.

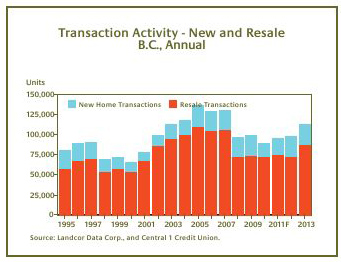

The survey noted that the inventory of homes for sale remained below 47,000 units for the third consecutive month in January, down 14 per cent from the spring of last year.

While the south Okanagan saw prices drop 8.9 per cent, from $310,000 to $283,000, the Okanagan Mainline (from Kelowna north) saw prices drop 2.9 per cent, from $387,000 to $376,000.

Vancouver Island prices dropped 5.7 per cent, from $328,000 to $309,000, while Victoria prices fell 4.5 per cent, from $510,000 to $486,000.

B.C. Northern prices fell 4.6 per cent, from $215,000 to $205,000, Chilliwack dropped five per cent, from $289,000 to $275,000, and Kamloops prices dropped 1.5 per cent from $314,000 to $309,000.

Powell River saw the steepest drop in the province, 29.6 per cent, from $301,000 to $212,000, while Kootenay bucked the trend in January with a 4.7-per-cent increase, from $264,000 to $276,000.

Muir said Vancouver is doing better because its economy is more diversified that the rest of B.C. and also has the advantage of significantly more immigrants, many of whom are in the investor class and typically buy a house upon arrival.

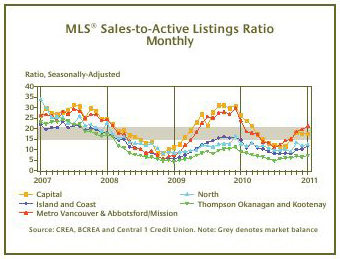

Muir noted that the Okanagan is in buyers’ market conditions, with 22 months of housing supply, meaning that it would normally take 22 months to use up the existing inventory.

“In Vancouver, it’s 6.1 months of supply. A balanced market is typically five to seven months.”

As well, he noted, one of the Okanagan’s main source of buyers – Alberta investors – has dried up, with many looking south of the border for cheaper recreational properties.

Carol Frketich, B.C. regional economist for Canada Mortgage and Housing Corp., said in an interview that while a one-month snapshot doesn’t tell the whole story, Metro Vancouver has generally done better than the rest of the province. “And Vancouver’s employment has been stronger than the provincial average. That provides a solid basis for the housing demand.”

Frketich noted that housing starts in the Vancouver CMA (census metropolitan area) saw a 57-per-cent hike in January to 1,436 from 917 in January 2010, with the Abbotsford and Kamloops CMAs also saw increases.

On average, urban centres saw a 15-per-cent rise over that period, although Frketich cautioned that one month doesn’t indicate a trend.

Meanwhile, Muir said he expects home sales to moderate this year as higher interest rates push mortgages up, impacting affordability.

He said there should be a “moderate improvement” in interior home prices in 2011.